Swoozie’s, Inc. (“Swoozie’s” or the “Debtor”) filed a petition on March 2, 2010 in the Bankruptcy Court for the Northern District of Georgia (case number 10-66316) for relief under Chapter 11 of Title 11 of the United States Code. The case has been assigned to Judge C. Ray Mullins. The bankruptcy petition was signed by Kelly Plank-Dworkin as President and Chief Financial Officer of the Debtor. The Debtor’s bankruptcy counsel is Wendy R. Reiss of the firm of Alston & Bird LLP of Atlanta, Georgia.

Bankruptcy Cases of Interest to Suppliers, Landlords, Lessors, Bankruptcy Creditors

Posts and discussion of recent bankruptcy cases of interest from a supplier, commercial landlord, equipment lessor or other unsecured creditor standpoint.

Southern Golf Bankruptcy – Debtor Background, Creditor Picture, Top Unsecured Creditors

Southern Golf Partners, LLC (“Southern Golf” or the “Debtor”) filed a petition on January 20, 2010 in the Bankruptcy Court for the Northern District of Georgia (case number is 10-61636) for relief under Chapter 11 of Title 11 of the United States Code. Whether the case will generate bankruptcy preference claims will largely be determined by the direction of the case – if the Debtor seeks to sell its business operations under a Section 363 sale the events leading to the bankruptcy would seem to make it a ripe for bankruptcy preference actions to be brought. In the initial stages, however, this case seems focused on rejection of leases.

The case has been assigned to Judge C. Ray Mullins. The bankruptcy petition was signed by A. Boyd Simpson as Sole Manager of the Debtor. The Debtor’s bankruptcy counsel is J. Robert Williamson of the firm of Scroggins & Williamson of Atlanta, Georgia.

We have provided a courtesy copy of the Southern Golf Docsheet™ Report for further contact information for the Debtor’s counsel and the U.S. Trustee assigned to the case and “first day” docket entries in the bankruptcy. The Southern Golf Docsheet™ Report will be updated periodically to identify subsequent developments.

27 Automotive Suppliers File Chapter 11 Bankruptcies in 2009; End of Year Status Summary; Likelihood of Bankruptcy Preference Recovery

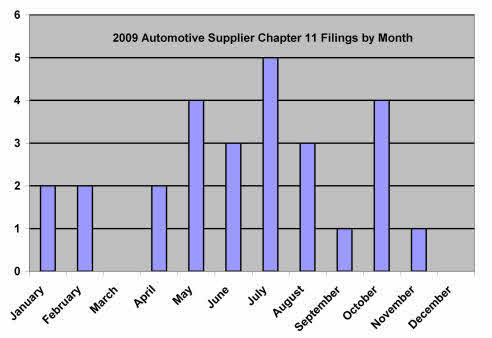

Pressures in the global automotive industry forced 27 FN1 automotive parts and component manufacturers and 2 automakers t o seek Chapter 11 bankruptcy protection in 2009. The number of filings is only the headline of the story. While estimated trade creditor distributions on prepetition claims swung the spectrum of 100% to 0%, estimated recoveries of less than 2 percent predominate. And more trade creditor pain looms in several bankruptcies, as bankruptcy preference action recoveries are either included in liquidation budgets, are necessary to avoid administrative insolvency or are likely to be sought by plan administrators and liquidation trustees.

o seek Chapter 11 bankruptcy protection in 2009. The number of filings is only the headline of the story. While estimated trade creditor distributions on prepetition claims swung the spectrum of 100% to 0%, estimated recoveries of less than 2 percent predominate. And more trade creditor pain looms in several bankruptcies, as bankruptcy preference action recoveries are either included in liquidation budgets, are necessary to avoid administrative insolvency or are likely to be sought by plan administrators and liquidation trustees.

This article provides a comprehensive list of the 27 automotive supplier Chapter 11 bankruptcies in 2009, together with status at the end of 2009, estimated trade creditor recoveries and the potential for avoidance actions.

Grede Foundries – Debtors’ Bankruptcy Preference vs Administrative Expense Ploy – A Tactic that Needs to be Stopped

In adding Section 503(b)(9) in the 2005 amendments to the Bankruptcy Code, did Congress intend that the supplier beneficiaries of the new section would wear a sign saying “BANKRUPTCY PREFERENCE TARGET – HIT ME”? This article challenges the growing use of bankruptcy preference actions under Section 547 to defeat and delay the allowance of Section 503(b)(9) administrative expense requests. As discussed below, the ploy subverts Congressional intent in adopting Section 503(b)(9). More fundamentally, the ploy ignores a basic tenet of the Bankruptcy Code that also is embodied in the prima facie requirements for bringing a bankruptcy preference action – “First Determine Priority.”

Grede Foundries – Debtor Onslaught to Disallow Supplier 503(b)(9) Administrative Expenses

Bankrupt retailer and manufacturer attacks on allowance of administrative expenses under Section 503(b)(9) of the Bankruptcy Code are increasing in frequency, breadth and ingenuity. One recent case in which pervasive attacks have been launched on supplier 503(b)(9) requests is the Grede Foundries bankruptcy where the debtor has sought to disallow more than 99% of suppliers’ $5,100,000 in 503(b)(9) expense requests. The following table summarizes the 8 objections made to 503(b)(9) requests in the Grede Foundries bankruptcy.

Grede Foundries – Preference Claims, 503(b)(9) Claims Opposition Precede 363 Sale

December 22, 2009 Update: On December 21, 2009, Grede Foundries filed the affidavit of Eric W. Ek in support of the of the Debtor’s motion to authorize the sale of assets. The affidavit provides both additional background and updated information regarding the proposed Section 363 Sale to Wazata Opportunity Fund II, LLC, through its subsidiary, Iron Operating, LLC. The affidavit reveals that there was an alternative bidder at the auction.

Recticel Interiors Bankruptcy – Background, Petition Information and Assessment of Direction

Recticel North America, Inc. (“Recticel NA”) and its subsidiary, Recticel Interiors North America, LLC (“Recticel Interiors”), filed bankruptcy on October 29, 2009 with the express aim of terminating the automotive parts supply contracts with its two largest customers – Johnson Controls, Inc. and Inteva Products, LLC. According to the debtors’ affidavit filed with the petitions, due to pricing issues, the supply contracts with these two customers alone had caused the debtors’ to incur “losses, on average, of approximately $600,000 per month on account of the Johnson Agreement and approximately $265,000 per month on account of the Inteva Agreement… .”

The following post provides basic identifying information about the bankruptcy, summarizes the debtors’ business, describes the debtors’ corporate structure, and gives a brief initial assessment of the direction of the bankruptcy.

Edscha North America Bankruptcy – Debtor Background, Creditor Picture, Top Unsecured Creditors

Edscha North America, Inc. d/b/a Edscha USA (“Edscha North America” or the “Debtor”) filed for bankruptcy on October 19, 2009 leaving Ford, General Motors, Nissan and Mercedes on its top 20 unsecured creditor list for accommodation payments made to keep the Debtor going. The OEM unsecured creditors’ and other unsecured creditors’ chances for any recovery of pre-petition claims appear to be slim.

The bankruptcy was filed in the Bankruptcy Court for the Bankruptcy Court for the Northern District of Illinois (case number is 09-39055) for relief under Chapter 11 of the US Bankruptcy Code.

Fountain Powerboats Bankruptcy – 363 Sale Credit Bid Rejected, Proposed DIP Financing Motion Approved

See the Fountain Powerboats Docsheet Report for subsequent developments in the Fountain Powerboats bankruptcy proceedings.

Following five and a half hours of testimony and final argument, Judge Randy D. Doub of the Bankruptcy Court for the Eastern District of North Carolina ruled on October 9, 2009 that the proposed Section 363 sale credit bid of Oxford Financial Group (“Oxford”) for the operating assets of Fountain Powerboat Industries, Inc. (“Fountain Powerboats”) was not in the best interest of the Debtor’s estate. The court instead approved a motion for Fountain Powerboats to obtain debtor in possession financing from Liberty Associates for an amount up to and including $1.5 million.

Goldens’ Foundry Bankruptcy – Debtor Background, Creditor Picture, Top Unsecured Creditors

Goldens’ Foundry & Machine Company (“Goldens’ Foundry” or the “Debtor”) filed a petition on October 2, 3009 in the Bankruptcy Court for the Bankruptcy Court for the Middle District of Georgia (case number 09-41222) for relief under Chapter 11 of Title 11 of the United States Code. Goldens’ Foundry’s primary business is the manufacture of gray and ductile iron castings for the transportation, construction, agriculture and energy markets. This post discusses the information provided in the initial filings, gives a preliminary assessment of the direction of the case from a supplier standpoint and provides the list of the top unsecured creditors.