Pressures in the global automotive industry forced 27 FN1 automotive parts and component manufacturers and 2 automakers t o seek Chapter 11 bankruptcy protection in 2009. The number of filings is only the headline of the story. While estimated trade creditor distributions on prepetition claims swung the spectrum of 100% to 0%, estimated recoveries of less than 2 percent predominate. And more trade creditor pain looms in several bankruptcies, as bankruptcy preference action recoveries are either included in liquidation budgets, are necessary to avoid administrative insolvency or are likely to be sought by plan administrators and liquidation trustees.

o seek Chapter 11 bankruptcy protection in 2009. The number of filings is only the headline of the story. While estimated trade creditor distributions on prepetition claims swung the spectrum of 100% to 0%, estimated recoveries of less than 2 percent predominate. And more trade creditor pain looms in several bankruptcies, as bankruptcy preference action recoveries are either included in liquidation budgets, are necessary to avoid administrative insolvency or are likely to be sought by plan administrators and liquidation trustees.

This article provides a comprehensive list of the 27 automotive supplier Chapter 11 bankruptcies in 2009, together with status at the end of 2009, estimated trade creditor recoveries and the potential for avoidance actions.

The Filing Trends

The 2009 calendar year turned the reorganization catchphrases “overleveraged”, “tightening covenant requirements”, “cost structure” and “deteriorating automotive markets” into company epitaphs. Of the 27 automotive supplier bankruptcies, 14 ended or are in the process of ending in Section 363 sales followed either by plans of liquidation, conversions to Chapter 7 or dismissals. In better times, many of these 363 sales may have been reorganizations.

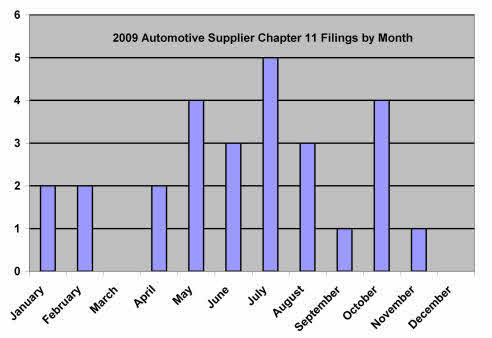

The only good news came in the last two months of the year. In November, 2009 there was only one Chapter 11 filing by an automotive supplier. There were no filings in December, 2009. The filings clearly peaked in May, June and July. In that 3 month period, there were 12 automotive supplier bankruptcies.

There potentially was one signal that the credit markets for automotive suppliers are starting to improve. Cooper-Standard was able to arrange for replacement DIP financing at a lower interest rate.

Who is and is not on the List of 2009 Automotive Supplier Bankruptcies

The following list does not include the bankruptcies of the General Motors or Chrysler, raw material suppliers or automotive industry manufacturers serving only the aftermarket segment. For example, we did not include Proliance International or Holley Performance because each serves only the aftermarket segment. The list also does not include the numerous companies that simply closed their doors with or without the filing of a Chapter 7.

There also was a necessary element of subjectivity in deciding what companies are and are not automotive suppliers. Our decision was based on two factors – (1) the identification in the bankruptcy filings of at least one automotive OEM or substantial automotive Tier 1 customer and (2) the type products manufactured. If we missed someone, please send us a comment (see below) or email.

FN1 In adding up the bankruptcies, each “administratively consolidated” bankruptcy was only counted as a single bankruptcy. If all of the co-debtors in these filings are counted, there were actually 241 automotive supplier debtors filing Chapter 11 in 2009.

LIST OF 2009 AUTOMOTIVE SUPPLIER BANKRUPTCIES

(Information as of 1/7/2010)

Accuride Corporation |

Filed: 10/8/2009 |

Status: Plan of Reorganization Pending |

||

|

Headquarters: |

Court: |

Discussion: |

||

|

Co-Debtors: 19 |

Case No.: 09-13449 |

|||

|

Products: |

||||

|

Trade Creditor Recovery: |

||||

|

Major Customer(s): |

Preference Claims: |

|||

Auto Cast, Inc. |

Filed: 8/24/2009 |

Status: Plan of Reorganization Pending |

||

|

Headquarters: |

Court: |

Discussion: |

||

|

Co-Debtors: 0 |

Case No.: 09-9958 |

|||

|

Products: |

||||

|

Trade Creditor Recovery: |

||||

|

Major Customer(s): |

Preference Claims: |

|||

B&C Machine Co., LLC |

Filed: 7/27/2009 |

Status: 363 Sale Pending |

||

|

Headquarters: |

Court: |

Discussion: |

||

|

Co-Debtors: 0 |

Case No.: 09-53294 |

|||

|

Products: |

||||

|

Trade Creditor Recovery: |

||||

|

Major Customer(s): |

Preference Claims: |

|||

Checker Motors Corporation |

Filed: 1/16/2009 |

Status: 363 Sales Closed |

||

|

Headquarters: |

Court: |

Discussion: |

||

|

Co-Debtors: 0 |

Case No.: 09-00358 |

|||

|

Products: |

||||

|

Trade Creditor Recovery: |

||||

|

Major Customer(s): |

Preference Claims: |

|||

Contech U.S., LLC |

Filed: 1/30/2009 |

Status: 363 Sales Closed; Case Converted |

||

|

Headquarters: |

Court: |

Discussion: |

||

|

Co-Debtors: 2 |

Case No.: 09-42392 |

|||

|

Products: |

||||

|

Trade Creditor Recovery: |

||||

|

Major Customer(s): |

Preference Claims: |

|||

Cooper-Standard Holdings Inc. |

Filed: 8/3/2009 |

Status: Seeking to Reorganize |

||

|

Headquarters: |

Court: |

Discussion: |

||

|

Co-Debtors: 12 |

Case No.: 09-12743 |

|||

|

Products: |

||||

|

Trade Creditor Recovery: |

||||

|

Major Customer(s): |

Preference Claims: |

|||

Crowe Manufacturing Services, Inc. |

Filed: 9/25/2009 |

Status: 363 Sale Pending |

||

|

Headquarters: |

Court: |

Discussion: |

||

|

Co-Debtors: 0 |

Case No.: 09-35939 |

|||

|

Products: |

||||

|

Trade Creditor Recovery: |

||||

|

Major Customer(s): |

Preference Claims: |

|||

Edscha North America, Inc. |

Filed: 10/19/2009 |

Status: Seeking to Reorganize |

||

|

Headquarters: |

Court: |

Discussion: |

||

|

Co-Debtors: 0 |

Case No.: 09-39055 |

|||

|

Products: |

||||

|

Trade Creditor Recovery: |

||||

|

Major Customer(s): |

Preference Claims: |

|||

Fluid Routing Solutions, Inc. n/k/a Carolina Fluid Handling Intermediate Holding Corp. |

Filed: 2/6/2009 |

Status: 363 Sale-Credit Bid-Closed; Case Converted |

||

|

Headquarters: |

Court: |

Discussion: |

||

|

Co-Debtors: 3 |

Case No.: 09-10384 |

|||

|

Products: |

||||

|

Trade Creditor Recovery: |

||||

|

Major Customer(s): |

Preference Claims: |

|||

Foamex International Inc. (2009) |

Filed: 2/18/2009 |

Status: 363 Sale-Credit Bid-Closed; Dismissal Motion Pending |

||

|

Headquarters: |

Court: |

Discussion: |

||

|

Co-Debtors: 7 |

Case No.: 09-10560 |

|||

|

Products: |

||||

|

Trade Creditor Recovery: |

||||

|

Major Customer(s): |

Preference Claims: |

|||

FormTech Industries, LLC |

Filed: 8/26/2009 |

Status: 363 Sale-credit bid-closed |

||

|

Headquarters: |

Court: |

Discussion: |

||

|

Co-Debtors: 2 |

Case No.: 09-12964 |

|||

|

Products: |

||||

|

Trade Creditor Recovery: |

||||

|

Major Customer(s): |

Preference Claims: |

|||

Fort Wayne Foundry Corporation |

Filed: 6/3/2009 |

Status: Plan of Reorganization Confirmed |

||

|

Headquarters: |

Court: |

Discussion: |

||

|

Co-Debtors: 1 |

Case No.: 09-12423 |

|||

|

Products: |

||||

|

Trade Creditor Recovery: |

||||

|

Major Customer(s): |

Preference Claims: |

|||

Global Safety Textiles Holdings LLC |

Filed: 6/30/2009 |

Status: Plan of Reorganization Confirmed |

||

|

Headquarters: |

Court: |

Discussion: |

||

|

Co-Debtors: 8 |

Case No.: 09-12234 |

|||

|

Products: |

||||

|

Trade Creditor Recovery: |

||||

|

Major Customer(s): |

Preference Claims: |

|||

Grede Foundries, Inc. |

Filed: 6/30/2009 |

Status: 363 Sale-Credit Bid-Authorized |

||

|

Headquarters: |

Court: |

Discussion: |

||

|

Co-Debtors: 2 |

Case No.: 09-14337 |

|||

|

Products: |

||||

|

Trade Creditor Recovery: |

||||

|

Major Customer(s): |

Preference Claims: |

|||

Hayes Lemmerz International, Inc. |

Filed: 5/11/2009 |

Status: Plan of Reorganization Confirmed |

||

|

Headquarters: |

Court: |

Discussion: |

||

|

Co-Debtors: 24 |

Case No.: 09-11655 |

|||

|

Products: |

||||

|

Trade Creditor Recovery: |

||||

|

Major Customer(s): |

Preference Claims: |

|||

J.L. French Automotive Castings, Inc. |

Filed: 7/13/2009 |

Status: Plan of Reorganization Effective |

||

|

Headquarters: |

Court: |

Discussion: |

||

|

Co-Debtors: 6 |

Case No.: 09-12445 |

|||

|

Products: |

||||

|

Trade Creditor Recovery: |

||||

|

Major Customer(s): |

Preference Claims: |

|||

Lear Corporation |

Filed: 7/7/2009 |

Status: Plan of Reorganization Confirmed |

||

|

Headquarters: |

Court: |

Discussion: |

||

|

Co-Debtors: 23 |

Case No.: 09-14326 |

|||

|

Products: |

||||

|

Trade Creditor Recovery: |

||||

|

Major Customer(s): |

Preference Claims: |

|||

Mark IV Industries, Inc. |

Filed: 4/30/2009 |

Status: Plan of Reorganization Effective |

||

|

Headquarters: |

Court: |

Discussion: |

||

|

Co-Debtors: 17 |

Case No.: 09-12795 |

|||

|

Products: |

||||

|

Trade Creditor Recovery: |

||||

|

Major Customer(s): |

Preference Claims: |

|||

Metaldyne Corporation nka Oldco M Corporation |

Filed: 5/27/2009 |

Status: 363 Sale-Credit Bid-Closed; Plan of Liquidation Proposed |

||

|

Headquarters: |

Court: |

Discussion: |

||

|

Co-Debtors: 31 |

Case No.: 09-13412 |

|||

|

Products: |

||||

|

Trade Creditor Recovery: |

||||

|

Major Customer(s): |

Preference Claims: |

|||

Michael Day Enterprises, Inc. |

Filed: 11/10/2009 |

Status: 363 Sale-Pending |

||

|

Headquarters: |

Court: |

Discussion: |

||

|

Co-Debtors: 1 |

Case No.: 09-55159 |

|||

|

Products: |

||||

|

Trade Creditor Recovery: |

||||

|

Major Customer(s): |

Preference Claims: |

|||

Noble International, Ltd. |

Filed: 4/15/2009 |

Status: 363 Sale; Plan of Liquidation Confirmed |

||

|

Headquarters: |

Court: |

Discussion: |

||

|

Co-Debtors: 14 |

Case No.: 09-51720 |

|||

|

Products: |

||||

|

Trade Creditor Recovery: |

||||

|

Major Customer(s): |

Preference Claims: |

|||

PTC Alliance Corp. |

Filed: 10/1/2009 |

Status: 363 Sale-Credit Bid-Pending |

||

|

Headquarters: |

Court: |

Discussion: |

||

|

Co-Debtors: 6 |

Case No.: 09-13395 |

|||

|

Products: |

||||

|

Trade Creditor Recovery: |

||||

|

Major Customer(s): |

Preference Claims: |

|||

Recticel North America, Inc. |

Filed: 10/29/2009 |

Status: Seeking to Reorganize |

||

|

Headquarters: |

Court: |

Discussion: |

||

|

Co-Debtors: 1 |

Case No.: 09-73411 |

|||

|

Products: |

||||

|

Trade Creditor Recovery: |

||||

|

Major Customer(s): |

Preference Claims: |

|||

Sanderson Industries, Inc. |

Filed: 5/11/2009 |

Status: 363 Sale-Credit Bid-Closed; Plan of Liquidation Confirmed |

||

|

Headquarters: |

Court: |

Discussion: |

||

|

Co-Debtors: 0 |

Case No.: 09-72311 |

|||

|

Products: |

||||

|

Trade Creditor Recovery: |

||||

|

Major Customer(s): |

Preference Claims: |

|||

Stant Parent Corp. n/k/a SPC Seller, Inc |

Filed: 7/27/2009 |

Status: 363 Sale-Closed |

||

|

Headquarters: |

Court: |

Discussion: |

||

|

Co-Debtors: 5 |

Case No.: 09-12647 |

|||

|

Products: |

||||

|

Trade Creditor Recovery: |

||||

|

Major Customer(s): |

Preference Claims: |

|||

Vincent Industrial Plastics, Inc. |

Filed: 7/29/2009 |

Status: Case Dismissed |

||

|

Headquarters: |

Court: |

Discussion: |

||

|

Co-Debtors: 0 |

Case No.: 09-41207 |

|||

|

Products: |

||||

|

Trade Creditor Recovery: |

||||

|

Major Customer(s): |

Preference Claims: |

|||

Visteon Corporation |

Filed: 5/27/2009 |

Status: Plan of Reorganization Pending |

||

|

Headquarters: |

Court: |

Discussion: |

||

|

Co-Debtors: 30 |

Case No.: 09-11786 |

|||

|

Products: |

||||

|

Trade Creditor Recovery: |

||||

|

Major Customer(s): |

Preference Claims: |

|||