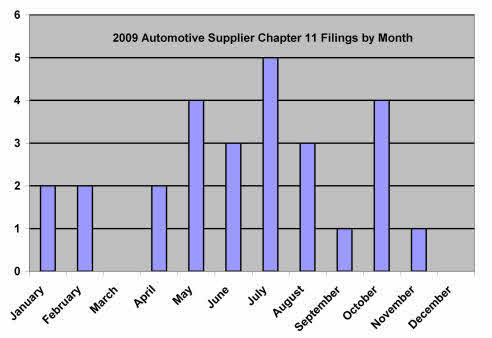

Pressures in the global automotive industry forced 27 FN1 automotive parts and component manufacturers and 2 automakers t o seek Chapter 11 bankruptcy protection in 2009. The number of filings is only the headline of the story. While estimated trade creditor distributions on prepetition claims swung the spectrum of 100% to 0%, estimated recoveries of less than 2 percent predominate. And more trade creditor pain looms in several bankruptcies, as bankruptcy preference action recoveries are either included in liquidation budgets, are necessary to avoid administrative insolvency or are likely to be sought by plan administrators and liquidation trustees.

o seek Chapter 11 bankruptcy protection in 2009. The number of filings is only the headline of the story. While estimated trade creditor distributions on prepetition claims swung the spectrum of 100% to 0%, estimated recoveries of less than 2 percent predominate. And more trade creditor pain looms in several bankruptcies, as bankruptcy preference action recoveries are either included in liquidation budgets, are necessary to avoid administrative insolvency or are likely to be sought by plan administrators and liquidation trustees.

This article provides a comprehensive list of the 27 automotive supplier Chapter 11 bankruptcies in 2009, together with status at the end of 2009, estimated trade creditor recoveries and the potential for avoidance actions.