As discussed in a prior post on the bankruptcy of Noble International Ltd., the parent and 14 subsidiaries have filed for bankruptcy. We have stressed the need to carefully identify your customer. We wanted to use the Noble International bankruptcy as a case study for point and were surprised to find that two debtors did not appear to be “insolvent” when they filed their Chapter 11 petitions.

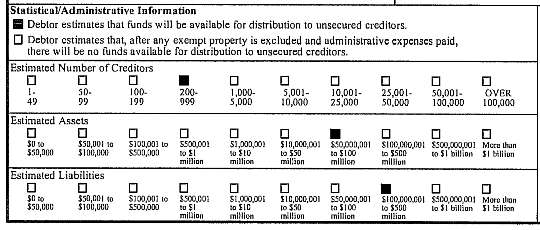

A Chapter 11 petition, includes a section called “Statistical/Administrative Information. The information is provided in a “check the box” format. The following is an illustration:

Illustration of Statistical-Administrative Data Section From Chapter 11 Petition

Don’t get excited about the checking of the box that says “Debtor estimates that funds will be available for distribution to unsecured creditors.” We have never seen the box not checked.

Usually the broad ranges used in this “statistical” gathering of information render the information of limited or no value. However, the information should be reviewed, because every once in a while the information yields a surprise. Noble is one of those cases.

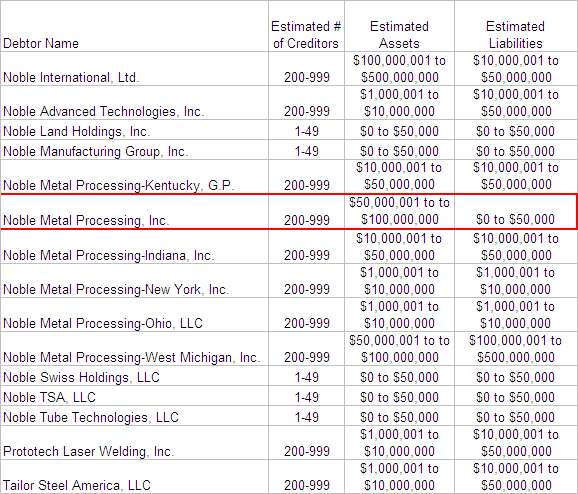

The following chart summarizes the “statistical” information from the Noble International bankruptcy petitions.

Comparison of Data from Petitions of 15 Noble Debtors

As you can see, both the parent, Nobel International Ltd., and one of the subsidiaries, Noble Metal Processing, Inc., value their respective assets substantially higher than the liabilities. Why is this important? There are numerous reasons but we will focus on 2.

First, unless the cases are “substantively consolidated”, each entity’s ability to make distributions to the unsecured creditors is determined on a debtor by debtor basis. So if you are a bankruptcy creditor and your customer has substantial assets in excess of liabilities then the chances for a distribution to you are better then if your customer has a more liabilities than assets. We stress that this information is not dispositive. Assets can “evaporate” and liabilities can escalate as the bankruptcy unfolds. But being in this position is a better place to start than the alternative.

Second, this information is vital for assessment of exposure to and defense of a bankruptcy preference claim. This relates to a basic element of a bankruptcy preference claim that is sometimes assumed.

In order for a payment to a bankruptcy creditor to be considered a preference, the payment must have been made “while the debtor was insolvent“. Unfortunately, the Bankruptcy Code states that “For the purposes of this section, the debtor is presumed to have been insolvent on and during the 90 days immediately preceding the date of the filing of the petition.” This means that to defeat a preference claim the bankruptcy creditor must overcome a presumption that the customer was insolvent throughout the preference period.

The Bankruptcy Code in Section 101(32) defines “insolvent” as “financial condition such that the sum of such entity’s debts is greater than all of such entity’s property, at a fair valuation… .” So that the petition shows assets so far in excess of liabilities creates the possibility that an element of a preference claim does not exist as to two of the Noble entities.

This is good news but again the information in the Chapter 11 petition is not dispositive of the issue. At best, the information flags an issue that must be examined repeatedly throughout these bankruptcies. The need opportunity to assess the insolvency issue will come when each of the debtor’s provides its separate schedule of assets and liabilities. That will come in the next 30 days (or longer if the deadline is extended by court order). Your company and its counsel should further assess this issue as actions are taken to protect your company’s interests as a bankruptcy creditor and as a bankruptcy preference defense strategy is developed.

As a case study, the Noble bankruptcy can be cited for the proposition that a customer’s insolvency should not be assumed and must be evaluated on a debtor by debtor basis in the case of a multi-debtor filing.